How I bought RDDT using Interactive Brokers, held for months, and sold after hitting my profit target.

In November 2024, I spotted something interesting on r/WallStreetBets — a post discussing how Reddit’s vast trove of user-generated content could be licensed to AI companies. The idea clicked: as AI grows, it needs more data to train on, and Reddit holds one of the richest archives of real human conversations on the internet. If that revenue stream took off, it could mean serious profits for Reddit, and by extension, a potential rise in RDDT’s stock price.

At the time, Reddit’s stock was trading around $79. I decided to make my move using Interactive Brokers (IBKR).

Why I Used IBKR to Buy RDDT

As a retail investor outside the US, IBKR is my go-to broker. It offers access to US-listed stocks like RDDT with competitive fees and fast execution. Funding is straightforward, the platform is reliable, and I can easily switch between currencies and markets without jumping through hoops.

My Entry: November 2024 at $79

I placed my order at $79 after seeing early discussions about potential AI licensing deals. My thesis was simple:

AI companies need large, diverse datasets

Reddit’s data is unique, community-driven, and highly valuable for AI training

If deals materialized, it could open a new high-margin revenue stream for Reddit

The Earnings Report That Changed Everything

Following Reddit’s next earnings report, the stock doubled in price. The market was reacting positively to growth prospects and investor sentiment was shifting. This was my signal to take the trade more seriously.

Adding More: 6 Shares at $141

To fund this larger buy, I withdrew from my BDO Life VUL policy — reallocating that money into what I believed was a stronger growth opportunity. I purchased 6 more shares at $141 through IBKR, bringing my total position to 7 shares.

Selling in Stages

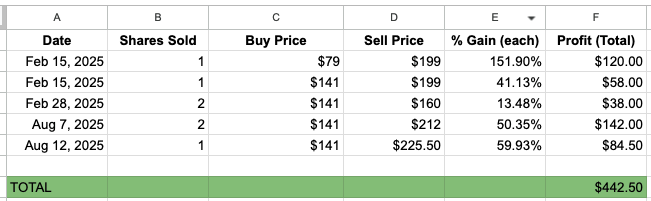

I didn’t sell all at once. Instead, I exited in multiple stages as the stock moved.

💰 Total profit from the 7 shares: $442.50

Lessons Learned

Start small, scale on conviction — that $79 starter share gave me early exposure while I confirmed my thesis.

Funding matters — reallocating from my VUL into a higher-conviction trade amplified my returns.

Catalysts move stocks — spotting the AI data licensing angle early was key to this trade.

Selling in stages works — it let me lock in gains while still participating in potential upside.

Final Thoughts

This RDDT trade combined a clear catalyst, a phased buying strategy, and disciplined exits. It also showed the value of having a global broker like IBKR, which made accessing and trading US stocks simple from my location.

Not every trade will have a storyline this clean, but this one was a reminder: when you spot a unique catalyst early and act with discipline, the results can be worth it.

Disclaimer: This article is for informational purposes only and is not financial advice. Always do your own research before investing.

Want to start investing in foreign stocks?

Use my link to create your account today!

Hey there my friends!

Recent Posts

More from MatipidNaDahon

Shirts for Developers 🌎👕

Shop link: WSKY

Chords for Indie OPM Songs 🎸

Site: chordplay.online